View 1098-T Form

The Form 1098-T Tuition Statement is used to help figure education credits for qualified tuition and related expenses paid during the tax year. The student, or the person who can claim the student as a dependent, may be able to claim an education tax credit on Form 1040 or Form 1040A.

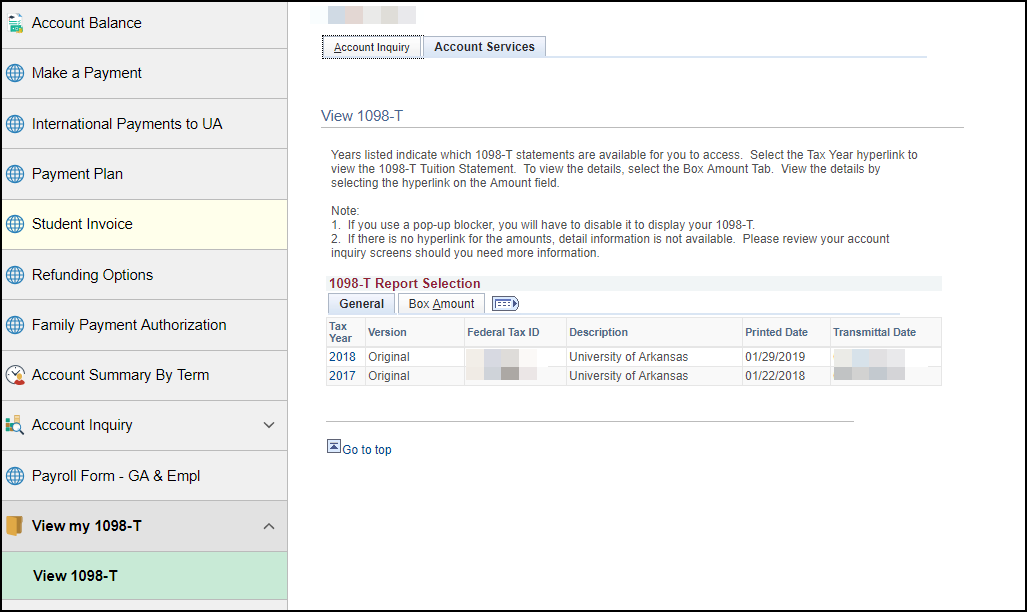

- Click the Treasurer's Office tile on the Student Homepage.

- Click the View 1098-T folder in the left menu.

- Click View 1098-T to display the 1098-T Report Selection.

- Click the specific Tax Year to display the 1098-T form for that year.

- Click the Box Amount tab to display detailed box information.

Note: You may need to disable the pop-up blocker on your web browser to display the 1098-T form.